Credit Card without Income Proof

If you are looking for a credit card without income proof in India, you will find this article very helpful. I did not have any income proof, but I needed a credit card to make international payments, like to pay for an Android app. I have State Bank of India savings bank account, so naturally I thought to have a credit card of the same bank. I searched for the credit card related information on Google. I came to know about SBI Advantage Card. SBI Advantage Plus is the another version of this card.

SBI Credit Card without Income Proof

SBI Advantage Credit Card require no income proof, but bank needs some guarantee. SBI opens Fixed Deposit of 25,000 rupees or 50,000 rupees in your name, so it can issue a credit card for you. The FD will have a lien in favor of SBI Cards. If you fail to pay the money within certain period of time, SBI will take to possession of your FD account.

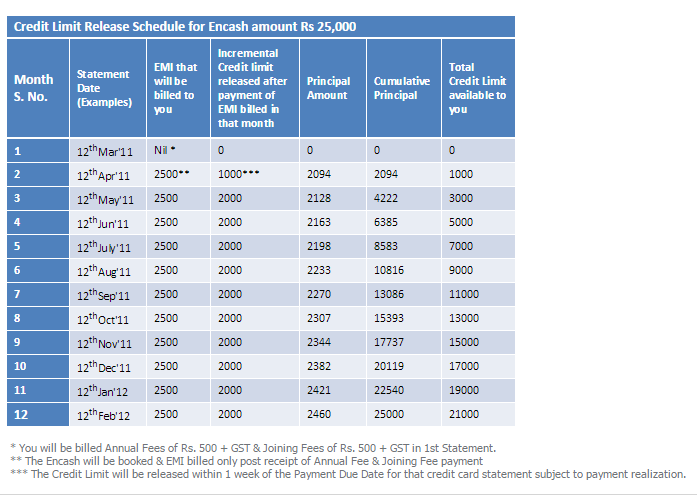

If 21000 Rs. credit limit is sufficient for you, you can tell the bank to open 25,000 Rs. FD (Fixed Deposit). If your requirement is more, you can tell the bank to open 50000 Rs. FD. There are two ways to pay the FD amount. You can either pay the whole amount at once to get SBI Advantage Card or you can pay the amount in 11 months using EMI to get SBI Advantage Plus Card.

I have opened the FD of 25 thousand rupees, but I have not payed the whole amount yet. EMI option can be little expensive, as bank will charge an interest of 19.5% per annum on reducing balance. The point is, you have to pay 27500 Rs. to open 25000 Rs. FD., as you have to pay 2500 Rs. interest. Bank will automatically renew your FD after its maturity. You will earn interest (555 Days @ 9.25%) on your fixed deposit.

I just received the intimation of my first EMI. The government tax is also included in the EMI amount, which is around 50 Rs. The total EMI amount is around 2550 Rs.

Note:

- The interest rate on SBI Advantage Plus Credit Card is 2.25% per month, that is 27% per year.

- Interest Free Credit limit is 20 to 50 days, which is applicable only on retail purchases and if the previous months outstanding amount is paid.

The SBI Credit Card’s website can be confusing for SBI Advantage Plus credit card users. I still completely not understood its working! I mean, I understand all the other options except the Account Summary shown on the dashboard. They were showing 27500 Rs. credit and cash limit last month, but Advantage Plus Card do not support that limit. This month they are showing credit and cash limit of 26000 Rs. I am still in the middle of the process and so I can not explain this all, but understanding the concept of Encash could be helpful.

What is Encash?

I am not sure, but Encash means the loan that SBI gives you on 19.5% interest rate to open your FD account. This could also explain why there was 27500 Rs. in my credit and cash limit last month.

Encash is a loan that SBI gives on a low interest rate over your credit card’s credit limit. For more information visit – Encash Option in SBI Card.

What is Extended Credit?

The extended credit means, you can use your credit card for the retail purchase and the interest will not be applicable for a certain period of time. For example, If I buy movie tickets using my credit card, I will not have to pay the interest for certain period.

What is Cash Limit?

You can use your credit card for the cash withdraw form ATM. You can withdraw up to 80% percent of your extended credit limit. The minimum fee will be 300 Rs. and you have to pay 27% per year interest rate from the day one!

SBI Advantage Plus Card Process

Let me make it simple for you! “Day” calculation is just to get an idea about the process and it is NOT very accurate. The following steps are mentioned according to my own experience.

- You go to the bank. (Day 1)

- You sign the form for a new credit card (SBI Advantage Plus Card). You need Passport Size Photo, Pan Card and Driver’s License or alternative address proof. (Day 1)

- You receive a verification call. (Day 7 – Day 15)

- You receive a Credit Card by post. (Day 18 – Day 25)

- The card will not be active, as you chose EMI option. (Day 18 – Day 25)

- You create an account on sbicards.com using your credit card number. (Day 18 – Day 25)

- You create a new pin. (Day 18 – Day 25)

- You see the outstanding balance in your account. 500 Rs. (Account Opening Charges) + 500 Rs. (Annual Charges) + 187 Rs. (Tax) = 1187 Rs. (Day 18 – Day 25)

- You pay the outstanding amount from your online savings bank account. (Day 18 – Day 25)

- You receive the intimation of your first FD EMI of around 2550 Rs. (Day 50 – Day 60)

- You still can not use your credit card. (Day 50 – Day 60)

- SBI receives your first installment of 2550 Rs. (Day 50 – Day 80)

- You can now use your credit card for the amount up to 1000 Rs. (Day 60 to Day 90 and onward)

- As you pay remaining 10 EMI of 2550 Rs., your credit limit will increase every month.

See the table below. It explains the relation of EMI and credit limit.

If you want to say something, or if you have a question, you can always use the comment box below. If you want to add an extra point or you want to correct me, feel free to do so. I would always like to listen form you.